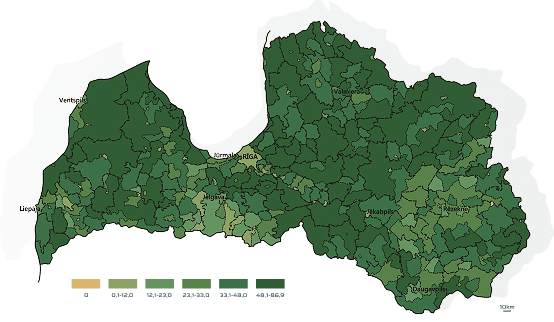

Latvian Forest Development Fund /LFDF/ specializes in acquiring and enhancing forest properties across Latvia. Through strategic forestland purchases and sales, we offer investors profitable and sustainable opportunities within Latvia’s thriving forestry sector.

Through our effective management, sustainable practices, and capitalizing on positive market dynamics, we’ve increased land value by around 35% per hectare, and we remain dedicated to sustaining this growth.

Robust demand in construction and energy sectors enhances profitability and market liquidity.

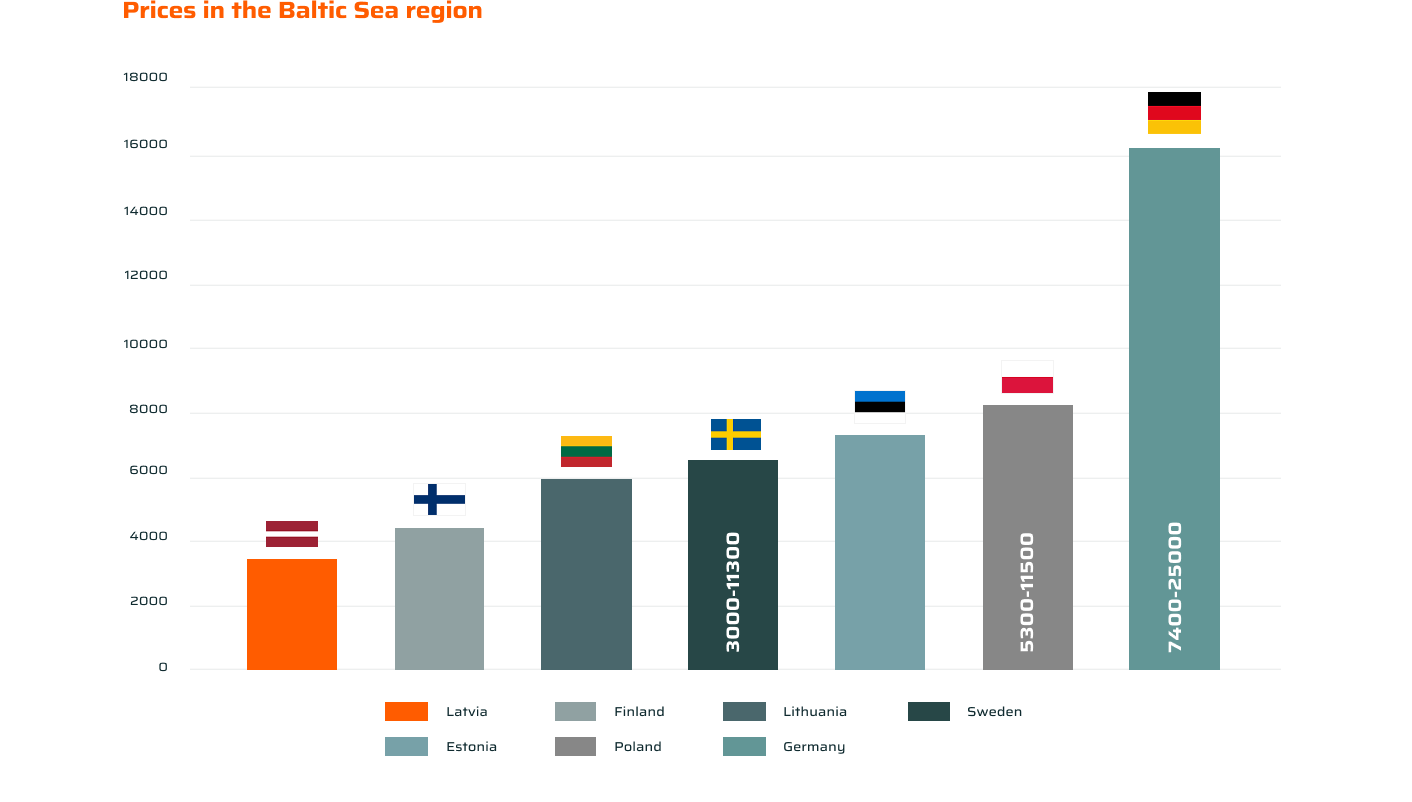

International companies like

IKEA and SODRA

are actively investing in Latvian forests.

Deals ranging from

€1.8 million to €5.1 million

in 2023 showcase robust market activity.

The fund is purchasing forest properties from local forest owners to grow Latvian forest land portfolio to 10,000 hectares in the next two years. LFDF is building a large collection of forest properties that attract investors and pension funds, providing stable and secure capital.